California’s state government has passed three disastrous budgets in less than a year: last week’s pillage followed agreements in February and last September that similarly robbed billions from social programs. Those earlier packages also included gifts to corporations in the form of giant new tax loopholes. So how can we stop this recurring nightmare? (I’m sure the question applies across the U.S. these days.) In my last (too-long) post, I put out some general ideas for moving forward. Today’s post will get into more detail about one major issue we need to confront: Proposition 13. In the next post I’ll look at other needed progressive tax reforms, and in the following post, give some thoughts on starting to build a fight back.

Confronting Proposition 13

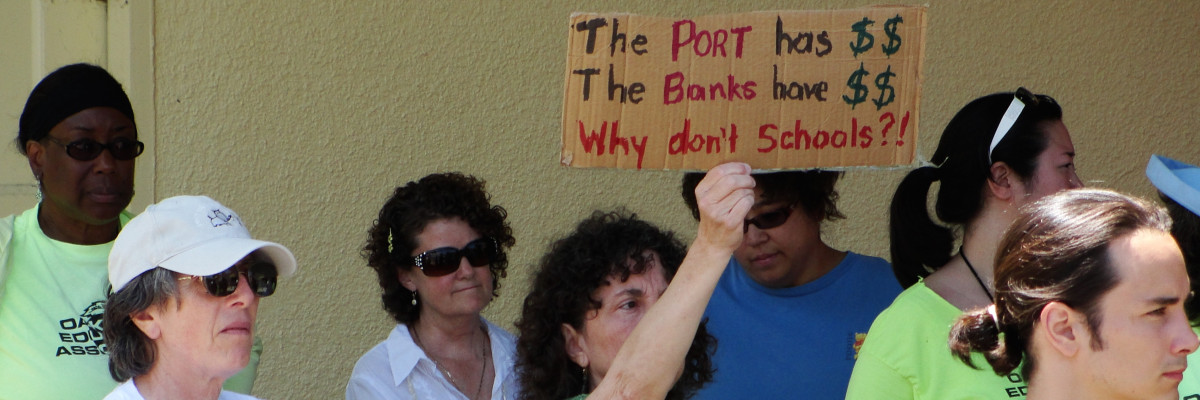

One of the most obvious reasons for California’s predicament is Proposition 13, the property tax-gutting measure that has devastated public schools and other services since it passed in 1979. The measure was sold to voters as tax-relief for homeowners, but the big winners have been big businesses. Since Prop 13’s passage the share of taxes paid by single-family residences has sharply risen, as the portion contributed by commercial and industrial properties has plummeted. That is because corporations avoid property reassessment for much longer periods than most homeowners do, by holding onto property longer or using legal loopholes to avoid reassessments even when they sell.

Before Prop 13 businesses contributed the lion’s share of property tax revenue; today single-family residences do. California’s Green Party says that businesses statewide used to shoulder 2/3 of property tax load to 1/3 for homeowners and that this proportion has virtually flipped. The county-specific percentages I’ve found for Los Angeles and San Francisco show a similar, if slightly less spectacular, trend.

So will the California Teachers Association (CTA) finally take up an effort to repeal Proposition 13? For years CTA leadership has focused narrowly on upholding Proposition 98’s funding guarantees for K-12. So CTA supported this “compromise budget” because it technically preserves Prop 98 “restores much needed funds to education once the economy improves.” (Never mind the history of the state government breaking similar promises in recent years to “pay it back.”)

Meanwhile CTA has limited its public criticism of Prop 13 to the part of that law requiring a 2/3 supermajority in each legislative body to pass revenue-related bills. True, that undemocratic provision ensures gridlock and favors fiscal conservatism and must change. But the larger problem is Prop 13’s huge corporate loopholes. Split roll taxation—treating corporate and industrial properties differently than individual homes—would provide a remedy.

CTA has long avoided campaigning for split roll, claiming that the public won’t support it. While a split roll initiative failed in 1992, much has changed since then. A Field Research survey last year found that the public narrowly supports a split roll that raises business taxes, and that an overwhelming majority favors an approach that lowers homeowners’ taxes. And maybe the latest budgetary kick in the face is getting through to CTA’s top leaders, too. More on that later.